Pay invoices on your terms

Product features

up to $500,000

pay in instalments

or account fees

with an ABN

How Trade Account works

Easily upload an invoice online

Your supplier is paid on time

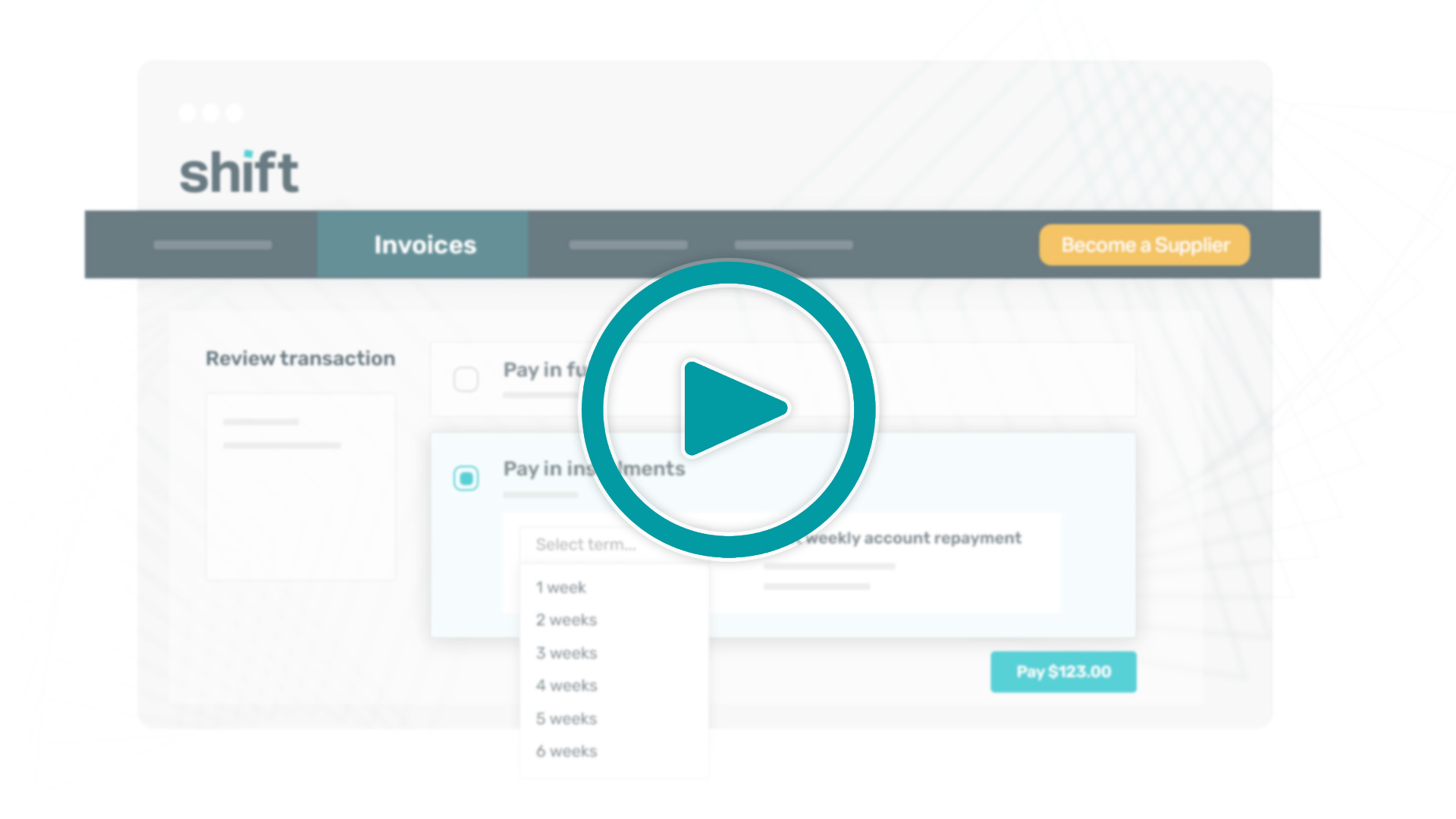

Choose terms suitable for your business

Repayments are made easy with direct debits

Timing is everything

Your suppliers are paid on time and you choose from flexible trade terms that work for your business.

Boost your purchasing power

Stock up when you need to. Buy more when your supplier is offering discounts. Pay on flexible terms.

Take control of cash flow

Pay every invoice on time while retaining the flexibility to align your payments to incoming cash flow.

Fuel your growth

What customers are saying

Red Rooster franchise owner

How businesses use their Trade Account

Trusted by 25,000 Australian businesses

Shift provides Australian businesses with credit and payment products, allowing them to take control of their cashflow, purchase assets and streamline trade terms.

Shift brings the same level of digitisation that consumers enjoy every day to the business world so businesses can manage their finances with ease, flexibility and control.

Since its founding in 2014, Shift has provided funding to support the growth aspirations of more than 25,000 Australian businesses.

FAQs

What is Trade Account?

Who can I pay through Trade Account?

Trade Account can be used to pay most suppliers. The primary requirement is that the supplier has an ABN. Your supplier does not need to have an account or a relationship with Shift.

There are a small number of exceptions. Trade Account is not able to be used to pay rent, royalties or wages.

How much does Trade Account cost?

The cost of Trade Account depends on the value of the invoice and the payment terms you choose for that invoice.

The transaction fee for an invoice is clearly presented in the platform before you confirm your preferred payment term. You can choose an option for an invoice, see the cost of that option and then decide whether you want to proceed . You can choose different options and compare the cost of each before you making a decision.

Trade Account does not have any establishment or account keeping fees.

What do I need to open an account?

To open a Trade Account, you will need an ABN, ID (either an Australian Drivers Licence or passport) and online business banking details.

All directors are required to register.

How do repayments work?

Repayments are automatically debited from your nominated business bank account according to the terms you selected for each invoice. You will receive a reminder two days before a payment is due, to let you know the amount that will be deducted from your account.

You can check your schedule of repayments online.

How long do I have to repay?

Open a Trade Account