Login to Shift Connect here. You'll only require your mobile number to login.

They should follow the same path for a broker and login here.

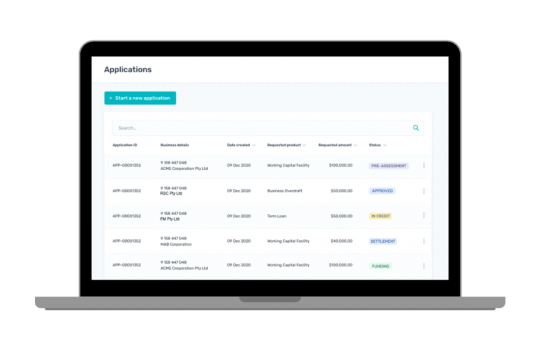

Pre-assessment: Our support team has received the application and are reviewing it to ensure we have everything we need to commence assessment. If our support team hasn’t received all the required information they will reach out to you promptly.

In-credit: our credit team is assessing your application.

Approved: your application has been approved.

Settlement: final review of the application is being undertaken by our settlements team to ensure all conditions have been met and can proceed to settlement.

Funding: application has been submitted for funding.

Settled: your application has been settled.

Rejected: your application has been declined.

Declined by client: your application has been withdrawn by the client.

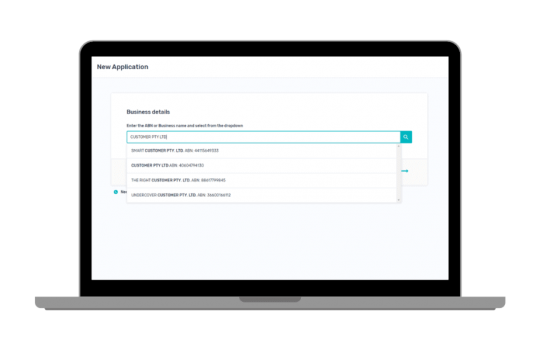

Go to the ‘Applications’ tab, to the ‘Business details’ section. You can search for the business based on:

An eligibility check will take place to verify that Shift can lend to the chosen business. If you experience any issues locating the business or need assistance, please call our broker support team on 1300 972 654.

If you’re unable to see director details, this is most likely because the client has an existing relationship with Shift through a previous broker. If you wish to view or make any changes to this application, please call our broker support team on 1300 972 654.

This is because the customer already has a relationship with Shift through a previous broker. We have all the information we need to progress your application and will be in touch soon.

Go to the ‘Applications’ tab, to the ‘Invitation’ section. There are 3 items in the Checklist:

I love how Shift Connect is extremely easy to use thanks to its simple layout. I’m particularly impressed with how fast it is to submit an application. It’s also a great experience for existing clients, as lodging a new application is a much smoother process.

– Chris Maamoun, Business Development Manager at Amfin.

Privacy Policy. Terms and conditions. Please consider the information before you decide whether the product is appropriate for your business. Standard credit assessment, fees, terms and conditions apply. The products and service offered are available in Australia from Shift Financial Pty Ltd. ABN 24 149 390 625, (“Shift”).