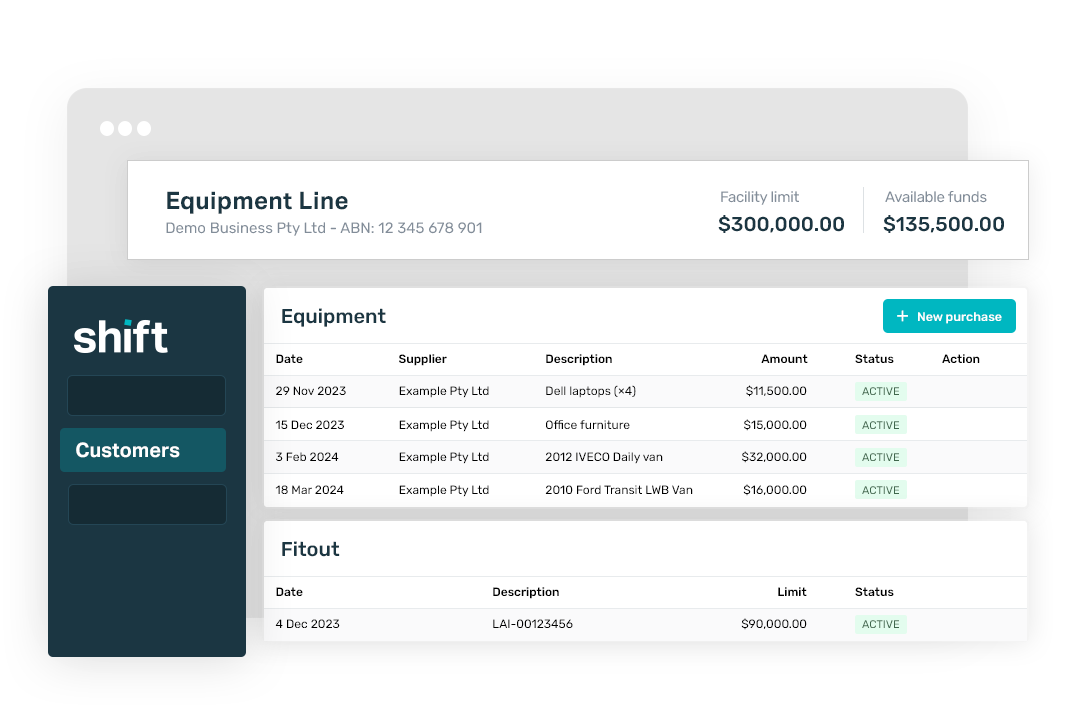

One solution for a broad range of needs

Suitable for businesses with:

Privacy Policy. Terms and conditions. Please consider all information provided to you carefully and seek independent legal/financial advice. Standard credit assessment, fees, terms and conditions apply. Our products are issued by Shift Financial Pty Ltd (ABN 24 149 390 625) or its subsidiary Shift Finance Australia Pty Ltd (ABN 54 601 158 507) (together "Shift").