For many businesses, trade credit is one of those activities that is so essential, it’s become effectively invisible. Accounts receivable teams follow processes that have been in place for decades, without counting the cost. Yet often those processes are complex, manual, and highly inefficient.

It doesn’t have to be this way. That’s why the team at Shift set out to revolutionise trade credit, with an online platform that lets suppliers get paid upfront, and lets buyers pay on their own terms.

We call it Shift Trade (formerly Shift Payments). It’s been so successful, it’s just won IDC’s Digital Disruptor of the Year. Here’s how we did it, and why it matters to every business looking to drive genuinely disruptive change.

The idea behind trade credit is simple. A supplier agrees to deliver goods or services to a buyer today, then get paid later – typically up to 60 days later. Yet that simple agreement has complex implications.

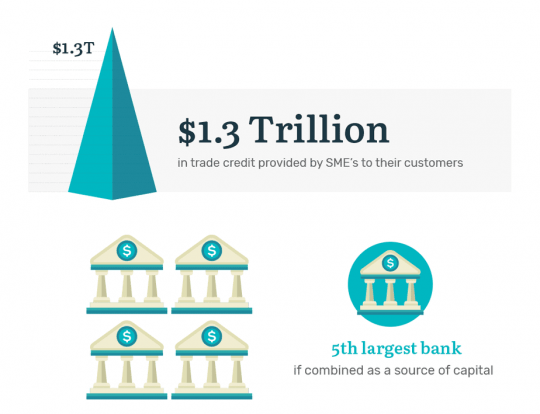

By granting trade credit, businesses are essentially acting as a bank to their customers. Considered as a group, suppliers are the largest non-bank finance providers in Australia.

Yet that doesn’t mean they’re thinking like banks. To provide finance with the same efficiency as a bank, businesses would need to develop a whole range of specialised functions: underwriting, limit setting, payment processing and collections, among others. They would need to understand the impact of delayed payments on their own working capital, and accurately price the cost of providing finance.

Most businesses simply do not have the expertise or the desire to act as true finance providers. For them, managing a complex credit program is a distraction from their core business. Yet many also operate in industries where trade credit is accepted practice, essential for driving sales and capturing ongoing business.

Shift Trade is a genuinely transformational B2B trade credit solution, a single platform that lets suppliers and buyers transact online with flexible terms.

Shift enables sellers to get paid upfront, as soon as they make a sale, and buyers to pay later, on the payment terms that suit them. Because Shift takes care of the complexities of negotiating terms, setting payment limits and managing collections, it essentially enables business owners to outsource the administration of accounts receivable – so they’re free to run their businesses, without dedicating time, money and people to managing trade credit.

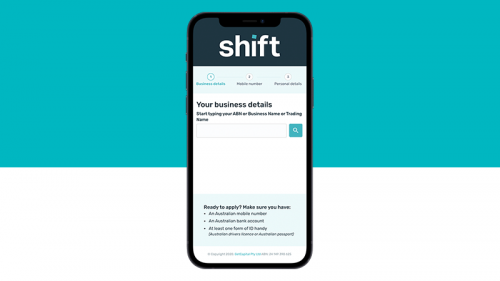

It only takes a few minutes for a business to sign up to Shift. Once on the platform, a business can invite and enrol customers with a simple ABN lookup, as well as using Shift to pay its own suppliers. That means Shift can act as a single entry point for both accounts receivable and accounts payable, enabling businesses to create and manage a network of trade relationships in a single place.

The development of our Trade platform is part of a digital transformation journey that has not only changed the way we create new solutions, but has fundamentally reshaped Shift as a business.

But you don’t have to take our word for it. Shift won IDC’s 2020 Digital Transformation Awards, recognised as both Digital Disruptor of the Year and Omni Experience Innovator.

Back in 2017, GetCapital was a successful non-bank lender, specialising in loans for small to medium enterprises (SMEs). We were growing rapidly, but with a largely traditional approach to lending and relationship-driven client service.

We recognised that the SME lending market was ripe for disruption. So we decided to become a disruptor – transforming ourselves into a digital experience (DX) led business, whilst maintaining the relationship model that Australian business owners have come to value. We became Shift.

Next, we set out to get the right talent on board, expanding our technology team and its capabilities by 500% and building a data science team from scratch. This wasn’t just a staffing change. It involved lifting and shifting our processes and culture, moving away from traditional project management towards agile development methodology across the business, with cross-disciplinary teams sharing their expertise to rapidly envisage, prototype and roll out new ideas.

We revisited the entire technology stack to support scalability and flexibility, establishing fundamental cloud native and API first principles. This meant moving away from a classic monolith architecture towards serverless cloud computing and platform-based microservices run on Kubernetes clusters. The use of containerisation helped increase delivery and rapid prototyping, making daily production deployments the new norm.

This new digitalisation strategy required a clear vision and direction from the very beginning of the transformation journey: every upgrade and feature needed to align with our core build-once-and-reuse principles.

True digital transformation is complex. Our DX strategy not only changed the way we do development but transformed the entire business. It didn’t all happen in a day: it was a gradual cultural evolution which is still ongoing, as we build trust along the way.

As a result of the changes, our focus has shifted from routine operations, to using the power of data democratisation, machine learning and predictive analytics to unlock new opportunities. We can serve and understand customers better, with solutions that deliver genuine value.

Shift Trade is a great example of this new strategy in action. When we developed the platform, we started with the customer experience, listening to customers to understand their perspective on trade credit.

We asked the unspoken questions that are often just assumed. Why do businesses provide credit to their buyers? How does it impact their finances and their processes, often in ways they may not be aware of? And what are the pain points, both recognised and unrecognised?

The more we probed, the more we realised the problem wasn’t well understood. Trade credit wasn’t just an added extra, it was fundamental to many business relationships. Yet most customers didn’t realise what it meant to be running an accounts receivable function, and how the complexities of providing credit and chasing payments were distorting their balance sheets and day-to-day operations.

We realised our solution needed to be so easy that it became virtually invisible – an enabler of existing business relationships, not a new relationship imposed over the top of them. This principle – invisibility through simplicity – underlies the entire Shift user experience. Every screen, every click and every tap has been carefully considered and refined. Our aim is to avoid making users think, looking for every opportunity to prefill data and remove unnecessary steps, screen by screen and click by click.

A good example is the registration process, which reduces a complex onboarding journey to just four steps. New customers don’t even need to type their names, just their ABNs, with Shift drawing on ASIC data to dynamically prefill director and corporate information. Automating the digital KYC process in this way, saves customers valuable time.

Yet we also recognised that customer experience is not a technology, but an end-to-end process. So we applied the same design principles to our front-line support and customer service teams, streamlining every step to create a consistent and integrated customer experience.

We also harnessed machine learning to re-engineer our own processes. That saw a credit decision process that once required five people to become completely automated – enabling us to deliver decisions in moments, while liberating our people to focus on customer service instead of operations.

Our DX journey is far from over, and there are more innovations to come. Right now, we’re developing a new integration ecosystem, so the platform can connect seamlessly to a whole range of accounting, workflow and CRM systems. And we’ll continue to question and re-engineer our own business processes, using machine learning to simplify, automate and accelerate everything we do.

For us, Shift Trade is not only a flagship product, but also an incubator and accelerator. Applying the learnings from Shift to our DX journey across the business will lead to further digital disruption, both for ourselves and for the market. Who would want it any other way?