Suppliers using Shift have seen sales growth of over 20% through a combination of new customer acquisition and an increase in average order value and purchase frequency.

I'm selling goods or services to other businesses.”

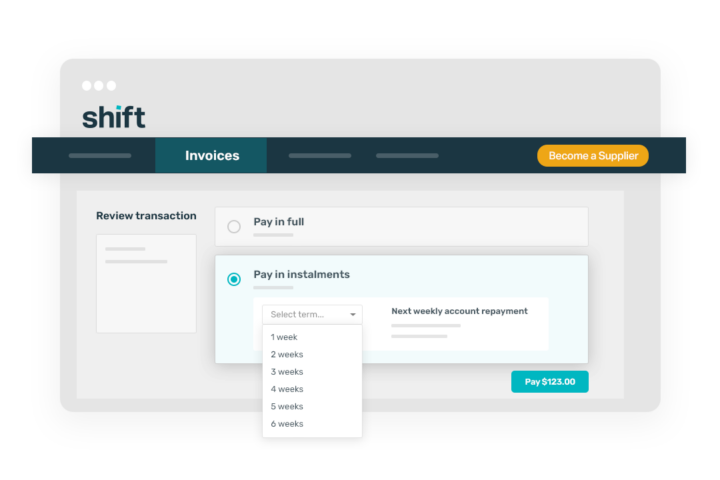

I'm buying goods or services for my business.”