Bank Connect

Frictionless online banking technology

Shift uses technology to make processes more efficient and to improve the user experience. We collaborate with technology partners to streamline credit applications.

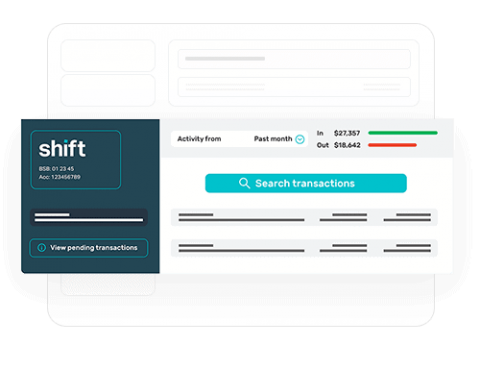

Our proprietary technology Bank Connect, allows bank statement data to be retrieved in encrypted form, creating less paperwork and facilitating faster credit decisions. We use the information you provide in credit applications to assess future applications, enabling frictionless and less time-consuming processes.

Your security is our highest priority

To complete the necessary credit and identity checks required to process business finance applications, we collect personal and business information. We ensure the highest levels of data protection and security.

Data security

All data sent via the Bank Connect channel is encrypted with bank level encryption.

Privacy policy

Keeping data secure is our top priority and we adhere to Australian privacy principles and laws.

Secure environment

Servers are in secure Australian data centres.We ensure the highest levels of data protection and security.

The reason we are focused on technology is to make things simple and seamless for our clients. We know that business owners are busy people, and finance is just one small part of their day-to-day. If our technology means less admin for them, then that is success for us.

Eldar Averdi

Chief Technology Officer

Less paperwork. Faster Approvals. Better outcomes.