Offering SME trade credit terms is standard practice for businesses in many industries. Both the amount of trade credit (the limit) as well as the length of the terms offered, are important elements of the overall trade relationship between buyer and seller.

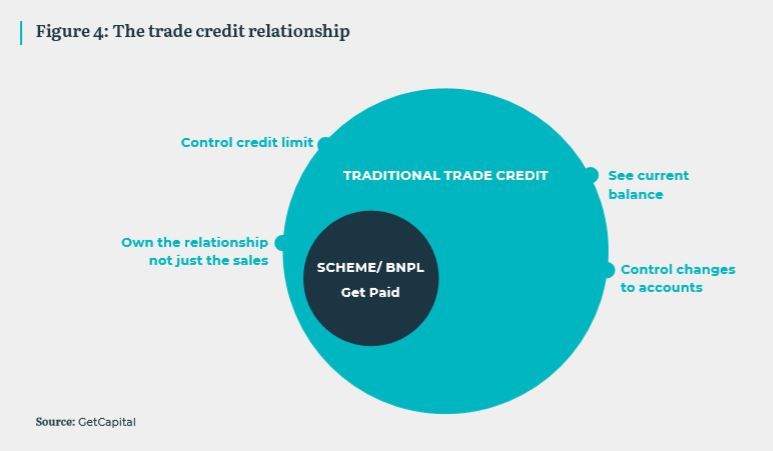

Part of the reason third-party finance solutions have not effectively disrupted in-house trade finance programs is that they fail to recognise that trade terms form a core part of the supplier-customer relationship.

Offering trade credit increases the stickiness of the customer relationship and provides the supplier with an additional (non-price related) tool to use in commercial negotiations with their customer.

Trade terms cannot simply be outsourced to a financier or be replaced by a financial product. Innovation of trade terms needs to balance the need to maintain the intimacy of the supplier-buyer relationship while removing cost and friction and adding flexibility to both parties.

Understanding the nature of this relationship provides useful insights into the characteristics a potential alternative should address in solving the deficiencies of the current trade credit model. It should acknowledge the intimate relationship between buyer and supplier and that the provision of trade terms forms an integral part of this relationship.

To be fair, a number of finance products exist today that attempt to solve the trade credit problem. However, all have significant drawbacks that make them impractical for a majority of SMEs.

For example, Supply Chain Finance often results in a Win-Lose scenario that amplifies the power of the larger party in the trade relationship.

When customers pay with card schemes, the traditional features of a supplier-run trade credit program – like checking a buyer’s available credit limit, having flexibility on a request limit, or the ability to charge an account directly – aren’t available. Without these features, suppliers will find it harder to be flexible or build rapport with their customers.

Factoring is not very transparent as accounts receivable are sold to third parties. And transparency is necessary to build trust in the trade relationship.

Easy trade relationships allow businesses to focus on what they do best. To address the intermingled issues of credit, payment and collections, the solution must be fit-for-purpose and be delivered via a single technology platform that recognises the recurring nature of trade between the parties but addresses changes in the needs of the parties over time.

Shift Payments is a flexible, independent trade account that serves both the buyer and supplier and removes the stress of trade terms from the relationship. With Shift Payments, suppliers can get paid immediately and buyers can control payment terms; allowing both parties to optimise without adversely impacting their relationship.

To learn more about SME Trade Credit, the case for a new model and how Shift Payments can streamline your payment terms, download the report.

For media queries, please contact media@shift.com.au