With so much business capital outstanding as part of the trade credit economy, it’s safe to say that nearly every business in Australia, large and small, is linked in some way to this vast ecosystem.

Far from a win-win solution, trade credit is actually quite complicated. Net terms range from 7, 14, 30, 60 days or more, but in practice are quite flexible and hard to enforce. On average, 96% of Australian businesses work with 30-day terms, but a large portion report consistently overdue payments by an average of ~10 days.[1]

So why do businesses provide trade credit in the first place?

To answer this question, we need to consider the dynamics of both the use (buyers) and supply (suppliers) of trade credit.

The case for using trade credit is fairly straightforward: it’s fit for purpose, low cost or no cost, it helps improve ROE, boosts business growth and assists with timing uncertainty.

The case for the supply of trade credit is less clear and associated with the fact that it has become standard market practice over time, can support buyers’ inventories and to improve bargaining power, among other reasons.

The issue is not the existence of trade credit, but instead the form in which it has been provided historically. The current model is chronically inefficient and puts a heavy toll on SMEs that provide trade credit.

First, it requires SMEs to provide financial services outside of their primary business; second, there is a high financial cost associated with holding large accounts receivables on balance sheet; and third, the cost and administrative burden from running an in-house trade credit program is significant.

In terms of the duplication of financial services alone and wasted time and effort:

Also, the use of trade credit tends to increase with business size (using employee numbers as proxy). This could reflect a weaker bargaining position of smaller businesses when compared to larger suppliers.

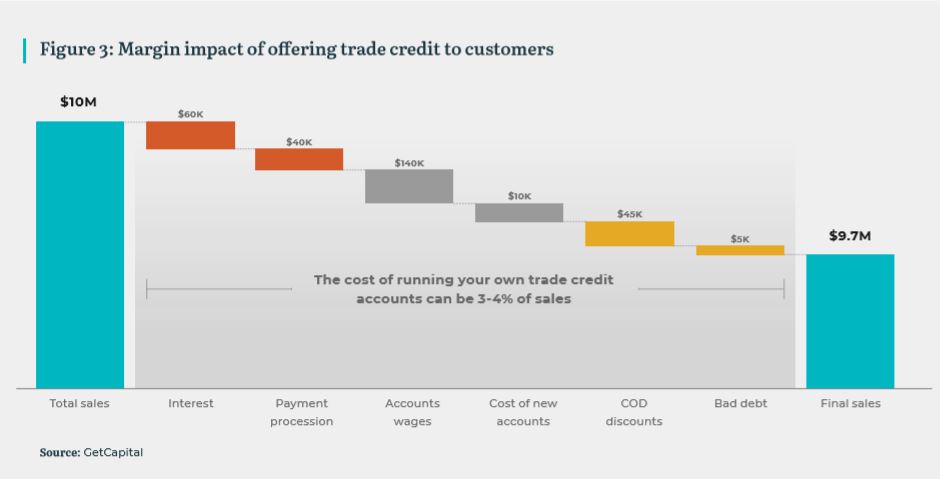

Extending trade terms ties up a lot of capital in accounts receivable and can have a real impact on profits – particularly for smaller businesses – as a result of the extra financial, administrative and related costs involved. GetCapital estimates that the cost of running your own trade credit account can reach anywhere between 3% and 4% of sales.

To learn more about SME Trade Credit and the case for a new model, download the report.

[1] Australian Late Payments Report, December Quarter Analysis 2019, ilion; Payment Times Inquiry in 2017 and Survey results – Payment Times and Practices Survey 2016-17, Australian Small Business and Family Enterprise Ombudsman.

[2] ABA, Employment Statistics

[3] Australian Government, Job Outlook, assumes $1,190 weekly wage for 93,300 accounts workers.

For media queries, please contact media@shift.com.au