Trade credit terms in Australia

Trade credit in Australia – as opposed to bank credit – is a vital source of business funding. By offering trade credit terms, goods and services can be exchanged before payment needs to take place, usually on interest-free terms that vary by industry and business type.

The exact terms make it possible for businesses big and small to manage short-term cash flows. It is estimated that Australian SMEs provide trade credit in the order of $1.3 trillion per year.[1]

These “net terms” are pillars of most supply chains and account for between 10% and 35% of all SME liabilities.[2] The use of terms is so widespread that, if combined as a source of capital, it would create the 5th largest bank in Australia by assets.[3]

Businesses are acting like banks

And since much of this trade credit is provided by non-financial institutions, it means everyday businesses across Australia are acting like banks.

The majority of this trade credit is provided by suppliers, with terms that range from 7 to 60 days. In aggregate, through these in-house trade credit programs, suppliers are practically the largest non-bank provider of finance in the country.

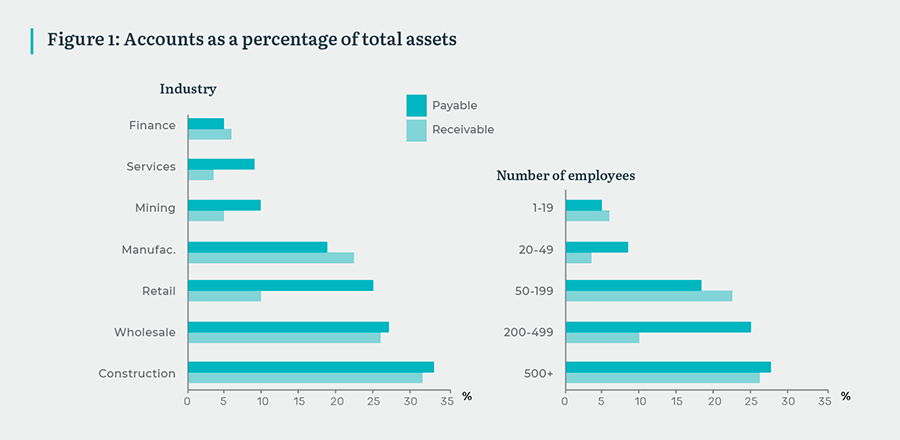

But trade credit is far from uniform: it varies by industry and business size.

The chart below shows accounts payable and receivable (using or extending trade credit as buyers and suppliers), relative to the company’s assets.

ndustries that are involved in the production or distribution of goods (construction, retail trade and wholesale trade) tend to use trade credit more intensively than say service and finance industries, which have reduced inventory requirements.

Also, the use of trade credit tends to increase with business size (using employee numbers as proxy). This could reflect a weaker bargaining position of smaller businesses when compared to larger suppliers.

Banks and other financial institutions have attempted to get involved in supply chain financing using an assortment of products like factoring, supply chain finance, card schemes and others. However, none of these solutions have been able to solve some of the more fundamental problems associated with trade credit: freeing up capital for buyers and suppliers, providing improved flexibility, and recognising that a trade relationship is more than just a financial transaction.

To learn more about SME Trade Credit and the case for a new model, download the report.

[1] Based on GetCapital analysis of RBA data with adjustments for consumer payments.

[2] Dun & Bradstreet; RBA, SME accounts payable dataset

[3] Assuming current outstanding accounts payable against the current assets of Australia’s 5th largest bank, ING.

About Shift

For media queries, please contact media@shift.com.au