Digitising trade terms

Cash flow has been a pain point for businesses of all sizes across various industries throughout history.

Fast forward to today and Australian businesses wait anywhere from seven to 60 days for customers to pay and are often chasing late payments beyond their terms.

Cash flow cycles don’t often align between a supplier and their customers. Cash flow gaps mean suppliers can struggle to pay ongoing expenses and other essential business costs.

It also means businesses are essentially acting as Australia’s fifth-largest bank, with Shift research showing businesses are providing an estimated $1.3 trillion annually in trade credit. Most businesses don’t have the infrastructure, technology, cash flow or resources to act as finance providers or manage complex credit programs.

I’ll pay you next week.

- mounting unpaid bills, including wages

- staff layoffs

- dipping into personal savings and equity

- potential business failure.

Another side effect of this expectation is that some businesses simply choose not to offer terms. This results in limited growth by driving potential customers to other suppliers who do offer terms.

The case for disruption

Shift, a provider of credit and payment platforms to Australian businesses, has made inroads towards solving the conjoined issues of credit and payments with Shift Trade, a low-friction, single-point solution that offers:

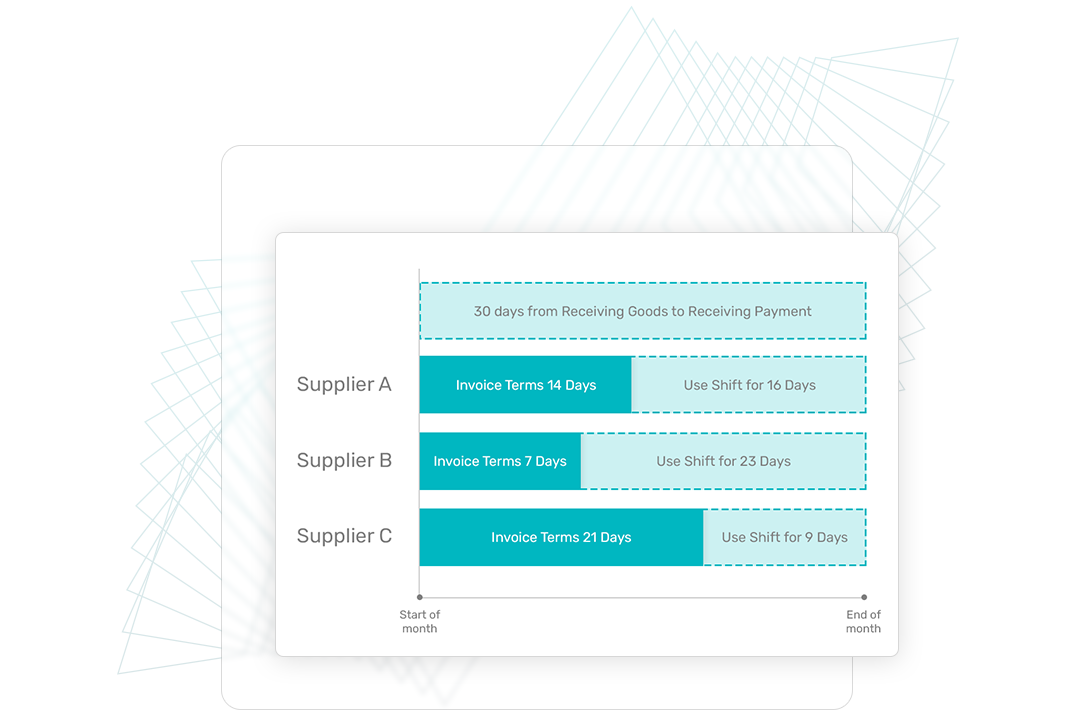

Closing the gap in cash flow cycles

Businesses making trade terms work for them

It’s a logical move when you consider Shift Business Index data from December 2022 that shows cafes spend around 58 per cent of their expenses on supplier costs while trying to grow, find staff and manage their business.

For example, a coffee roaster might sell thousands of kilos of beans a week on 14 or 30-day payment terms, which means they don’t see any of the funds for up to a month. And that’s on the proviso their customer pays on time.

The resulting cash flow issues create stress and background noise that can deplete reserve funds needed for the unexpected and inhibit growth.

How does it work?

The platform easily adapts as customers trade needs change over time.

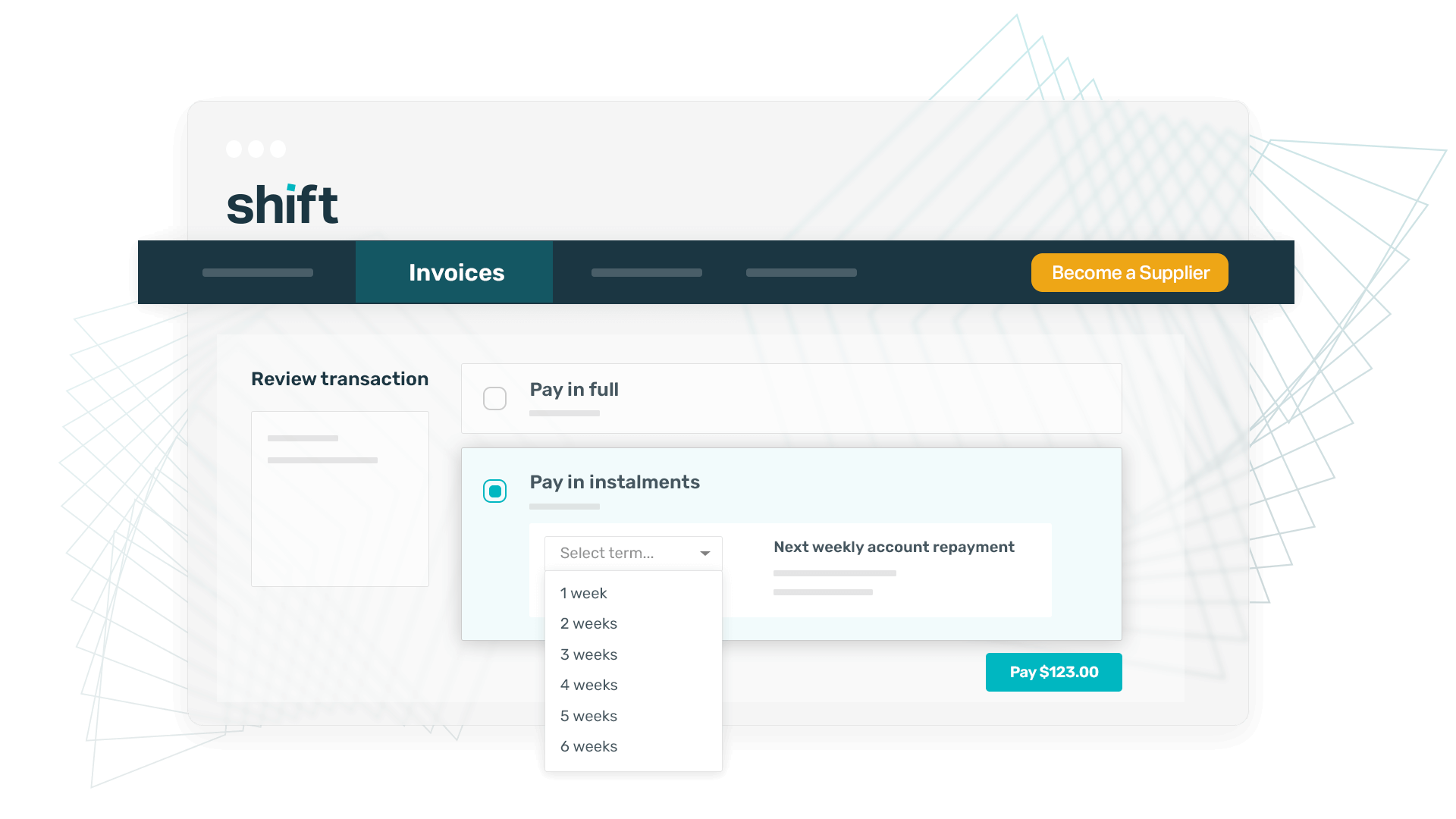

It gives customers the flexibility to extend payments, pay their invoice in full and request credit limit increases, all online via the Shift Trade platform.

Suppliers save time on administration and managing accounts, so they’re free to run their business while giving all customers an easy-to-use trade account to manage supplier invoices.